The U.S. accounting deficit was $180.4 billion at the tip of the fourth quarter in 2020. This figure represents the flow of products, services and investments into and out of the U.S. For the first quarter of 2021, that variety came in at $74.4 billion, reflective the continued impact of the world pandemic.

This figure shows what proportion a lot of americans, businesses, and government are borrowing from their foreign counterparts than they’re dispositing.

The main wrongdoer behind this account deficit is that the U.S. deficit. In 2020, It was $679 billion.

Causes

Why would the richest country on earth ought to borrow cash to sustain its economy? It’s attributable to the deficit. Americans pay a lot of on imports than U.S. businesses export.

Important: The U.S. is in a position to borrow enough to procure its deficit attributable to the demand for U.S. Treasury notes. The federal guarantees U.S. Treasury notes, thus investors contemplate them the safest investment within the world.

The following factors contributed to the U.S. deficit’s size by driving investors to Treasuries.

- The global securities market crashes in 2000 and 2008 sent investors fleeing from stocks.

- To endure the following recessions, governments down prime disposition rates. That created associate more than money trying to find a secure investment.

- In the Eighties, resident countries had bother coupling their foreign debt once years of borrowing from U.S. creditors.

- The Federal Reserve raised interest rates within the mid-1990s to combat inflation. These higher rates enticed investors to shop for Treasurys. With augmented international economic turmoil, investors saw Treasurys as a secure haven.

- In the late Eighties, Japan’s housing market folded, conveyance down the country’s economy.

- The Bank of Japan (BOJ) aroused the economy by printing yen. Japanese firms distended, causation exports into the U.S. market. They changed the bucks they received for native currency. The BOJ used these bucks to shop for Treasury notes, changing into one in every of the most important holders. That conjointly augmented the strength of the dollar and depressed the worth of the japanese yen.

- China did a similar issue. As a result, China is that the second-largest foreign holder of U.S. debt.

The Threat to the world Economy

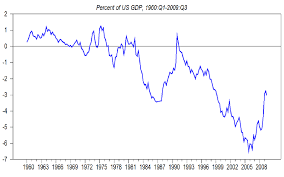

Many specialists round the world suppose the U.S. accounting deficit is that the greatest threat to world prosperity. Congress became involved once the deficit hit a record of $816 billion in 2006.1 That was a dramatic increase from $124 billion simply 10 years earlier. Congress was involved, as a result of no country ever had a deficit that enormous. Most specialists in agreement that it absolutely was unsustainable.

The sheer size of the deficit raised issues regarding whether or not the U.S. economy may pay an honest come back to investors. nobody is aware of what this tipping purpose can be, as a result of no country with associate economy this massive has ever run a deficit this massive.

Warning: If foreign investors were to panic and begin marketing U.S. assets at any value, they may cause the dollar’s price to collapse. that might produce a worldwide economic condition.

During the nice Recession, this account deficit fell to $380 billion as trade and finance dried up. With trade wars heating up in 2017, this account deficit fell even additional, to $365 billion.6 however the factors that caused the deficit remained. These embody high client debt, the U.S. federal deficit and debt, and high savings rates in Japan and China. If not addressed , these factors may limit U.S. economic process.

How to cut back the Threat

In 2007, the legislative assembly Budget workplace (CBO) reportable 2 choices to the Budget Committee of the House of Representatives. the primary was to extend personal savings while not tax incentives. the next domestic savings rate would provide the required capital while not borrowing overseas. One great way to extend the non-public savings rate would be automatic payroll deductions for 401(k) plans. Studies show that individuals square measure over willing to save lots of if they do not ought to build the choice. If they need to cop out of payroll deductions, they have a tendency to not know.

The CBO conjointly asked Congress to completely review choices that constrain the value of care. that is one in every of the most important elements of state outlay. Reducing that might lower the deficit.

The CBO warned that its suggestions would scale back personal consumption, that is what drives nearly seventieth of value growth. The next savings rate would cause a lower U.S. commonplace of living. Most politicians wouldn’t be in favor of the changes, attributable to the threat of not obtaining re-elected.

But the CBO aforesaid this was preferred to a drawn-out dollar decline and also the risk of a explosive dollar collapse.

Why Some are not upset

Despite the higher than arguments, several specialists state that the sheer size and importance of the U.S. economy can forestall any fatal crash. All loaner countries would work diligently to stay the U.S. economy afloat. They apprehend that if the U.S. ship goes down, all of their ships can, too. They conjointly notice that, at some purpose, different countries can stop disposition the us cash to shop for their merchandise. however they expect the method to be stable and with very little negative impact.

The rising U.S. accounting deficit is slowly creating different investments a lot of engaging. that is occurring at a similar time 5 different factors are in play:

- The global securities market is changing into a lot of clear.

- Latin American and Southeast Asian countries became a lot of receptive investment.

- Japan’s economy is slowly growing. Some even say that Japan’s earthquake may eventually spur economic process.

- Many central banks failed to drop rates as low because the U.S Federal Reserve did. that creates their own countries’ bonds look a lot of engaging.

- U.S. senators place pressure on China to lift its currency to permit the us to become a lot of competitive. the upper China permits its currency to rise, the less Treasury notes it desires.

But the CBO has the last word. It warned that even a gradual decline within the dollar price would cause a lower U.S. commonplace of living. It may produce inflation from higher-priced imports, which might come on interest rates.

How the U.S. accounting Deficit is a component of the Balance of Payments

In a country’s accounting, the balance of payments (BOP) is that the overall record of its international transactions. It consists of the money account, the capital account, and also the accounting.

The money account (once referred to as the “flow of funds account”) measures the acquisition of assets within the country’s economy. The capital account records capital transfers between U.S. residents and non-residents. this account measures its balance of trade also as investments and web payments. The balance of trade is that the largest portion of this account. If the country spends a lot of on imports than it exports, then this account is claimed to be in “deficit.”

U.S. exports were $2.13 trillion in 2020, whereas imports were $2.81 trillion. That place the U.S. deficit at $679 billion for 2020.